Council Tax

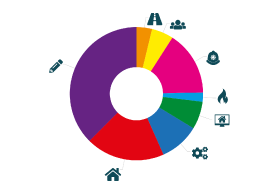

Council Tax is set by the council to help pay for the services provided in your area. Council Tax is the current form of local taxation for domestic properties which local authorities use to raise money to pay for around 17% of the cost of local services such as Education, Social Services, Refuse Collection and so on.